Here are few mortgage facts that will be useful to know if you’re looking to buy a home and needing a mortgage. See the links at the side to several mortgage calculators.

-

-

- With less than a 20% down payment your mortgage will be considered “high ratio” and you will be required to have loan insurance. The fee for this insurance is typically added to your mortgage principal and included in your monthly payments.

- Most lenders will require at least a 5% down payment.

Ensure you are able to comfortably support your mortgage!

- If you are unsure about how much you can afford, you should speak to a lender to find out. You can talk to a lender at any point throughout your search for a new home.

- For a guaranteed interest rate for a specified period of time (typically 30 to 90 days), go to a lender in the initial stages of your home search. This way you will have a guaranteed interest rate, even if the interest rate rises.

- Lenders consider many factors when looking at how much you can borrow. Things such as credit history/rating, income, employment, savings, debt, typical expenses (such as property taxes), etc.

- Shop around for the best rates and terms for your mortgage.

- You are required to have mortgage loan insurance if your down payment is 20% or less. The fee for this insurance is typically added to your mortgage principal and included in your monthly payments.

If you are unsure about how much you can afford, you should speak to a lender to find out. You can talk to a lender at any point throughout your search for a new home.

|

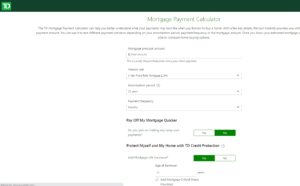

Mortgage Calculators

Bank of Montreal

CIBC

Meridian Credit Union

Scotiabank

TD Bank |